The Central Board of Direct Taxes (CBDT) has released the provisional figures of Gross Direct Tax Collections, Refunds, and Net Collections for the Financial Year 2025-26, reflecting continued buoyancy in tax revenue and strong economic activity across sectors.

Gross Direct Tax Collections

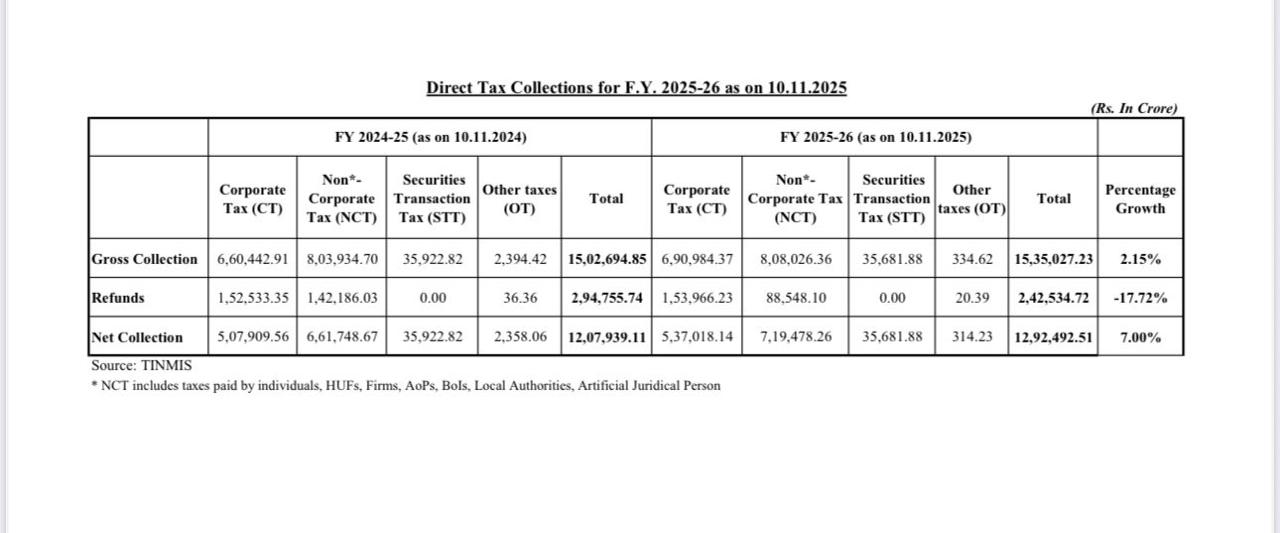

As per data released by the CBDT, the Gross Direct Tax Collections for FY 2025-26 (up to 10 November 2025) stood at Rs 15.35 lakh crore, showing a growth of around 2.15% compared to Rs. 15.02 lakh crore collected during the same period of the previous financial year. This includes revenue from:

• Corporation Tax (CT)

• Personal Income Tax (PT) (including STT – Securities Transaction Tax)

The moderate but steady increase indicates resilience in corporate earnings and individual tax contributions despite global headwinds.

Refunds Issued

Total refunds amounting to Rs. 2.42 lakh crore have been issued during the same period, which is about 17-18% lower than refunds issued up to 10 November 2024.

The reduction in refunds largely reflects improved accuracy in tax deductions, lesser mismatch in returns and faster processing efficiency under Faceless Assessment & Refund Processing systems.

Net Direct Tax Collections

After accounting for refunds, Net Direct Tax Collections stood at Rs. 12.92 lakh crore, showing a growth of nearly 7% over the corresponding period of the previous year. This growth has been primarily driven by:

• Strong corporate tax payments (advance tax installments)

• Consistent growth in TDS and self-assessment tax receipts

• Better compliance from salaried and business taxpayers

Significance and Implications

The robust performance of direct taxes reflects the overall stability of India’s tax base and the impact of ongoing digital and compliance reforms undertaken by the Income Tax Department and CBDT. Some key takeaways include:

• The tax-to-GDP ratio continues to improve, strengthening fiscal capacity.

• Digitalisation and e-compliance initiatives have reduced leakages and improved accuracy

• Steady growth in advance tax payments indicates optimistic corporate profitability trends.

Year-End Outlook

With five months still remaining in the financial year, the CBDT remains confident of meeting or surpassing the budgeted direct tax collection target for FY 2025-26.

The next round of advance tax payments (due in December 2025) will be a key indicator of the year-end momentum.

The direct tax data for FY 2025-26, as on 10 November 2025, highlights India’s strong fiscal position and the success of technology-driven tax reforms. With stable corporate profits and rising personal income compliance, India’s direct tax path continues to move upward—reinforcing confidence in both governance and growth.