The Pension Fund Regulatory and Development Authority (PFRDA) has issued a major update on December 1, 2025 expanding investment choice options for Central Government (CG) subscribers under the National Pension System (NPS) and Unified Pension Scheme (UPS).

The circular — PFRDA/2025/21/Reg-PF/03 — follows the Gazette Notification No. FX-4/2/2025-PR issued by the Ministry of Finance (Department of Financial Services) on 13 November 2025. With this change, the total number of investment options available to government employees has increased from four to six.

Existing Investment Options under NPS and UPS

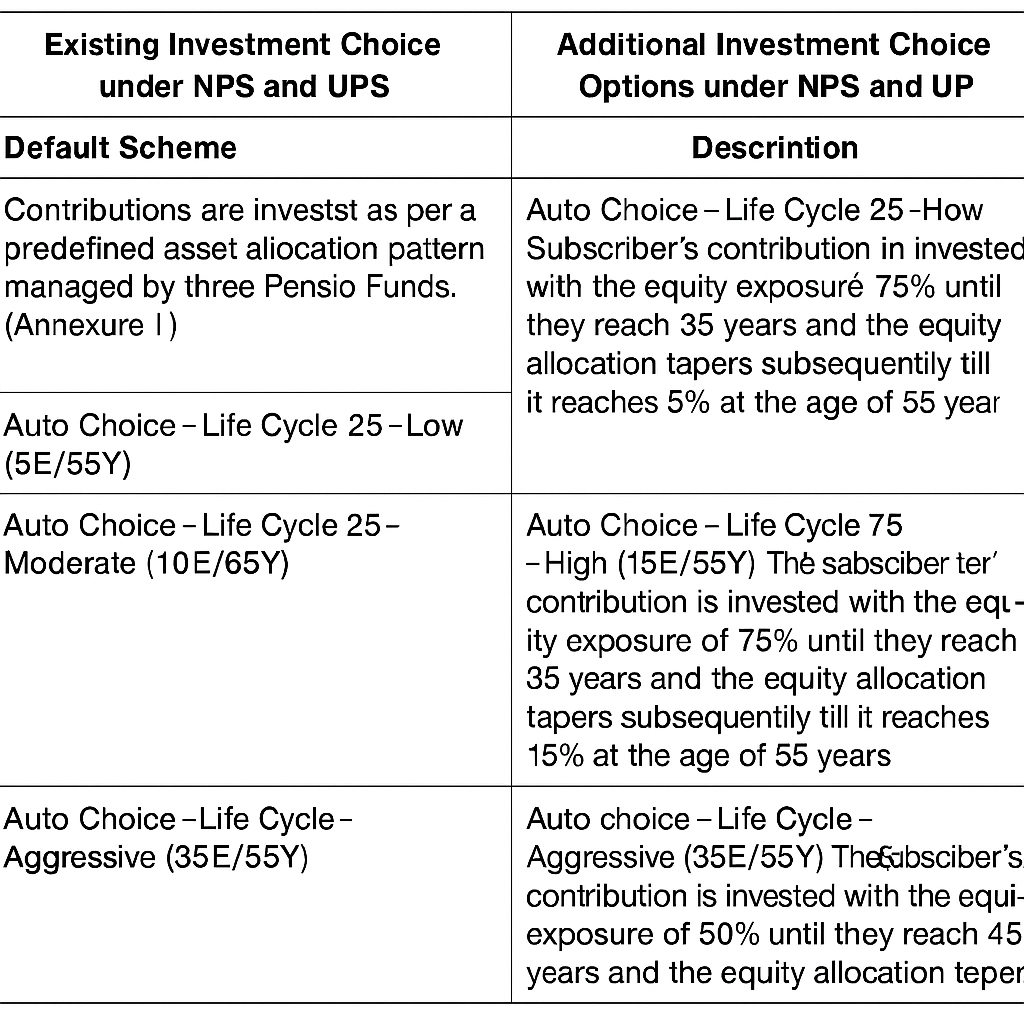

Until now, Central Government employees could choose among four types of investment schemes:

1. Default Scheme – Managed by three pension funds as per a predefined asset allocation pattern (Annexure I).

2. Active Choice (100% G-Sec) – Entire contribution invested in Government Securities.

3. Auto Choice – Life Cycle 25 (LC25 – Low Risk) – 25% equity till age 35, tapering to 5% by 55.

4. Auto Choice – Life Cycle 50 (LC50 – Moderate Risk) – 50% equity till age 35, tapering to 10% by 55.

According to PFRDA, around 4% of Central Government subscribers currently opt for an investment pattern other than the default scheme.

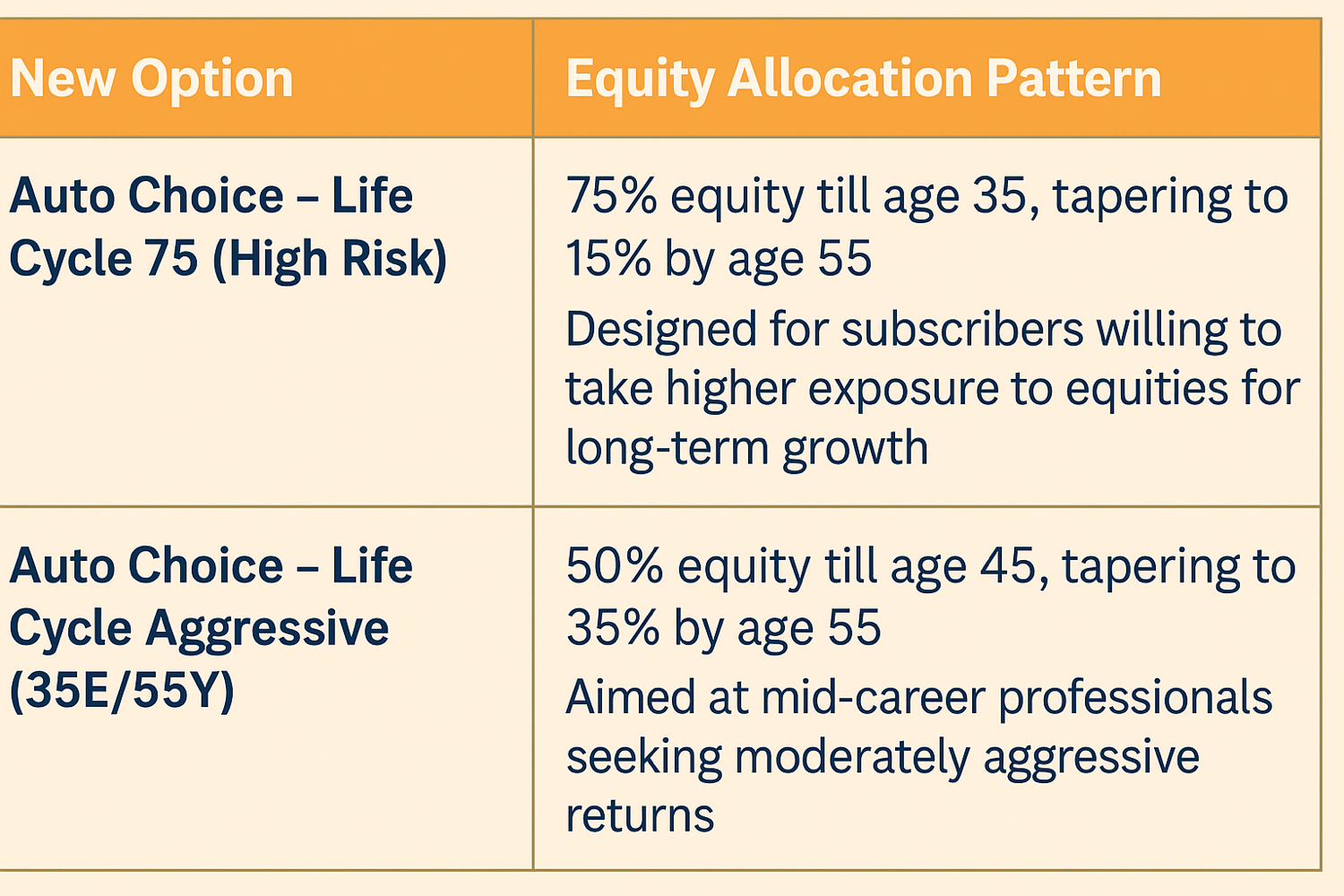

Two New Investment Options Introduced

The new circular introduces two additional Auto Choice (Life Cycle) options allowing subscribers greater flexibility based on their risk appetite and retirement goals:

What Subscribers Need to Do

Subscribers choosing any of the five non-default options must:

- Select one investment choice other than the Default Scheme and

- Choose one Pension Fund from the ten Pension Funds registered with PFRDA.

The PFRDA advises all subscribers to make informed decisions after reviewing fund performance on the NPS Trust website.

Rationalization of Life Cycle Fund Names

As part of the reform, PFRDA has also standardized the nomenclature of Auto Choice / Life Cycle (LC) Funds to ensure consistency with asset allocation patterns and age-based tapering structures.

This was previously addressed in Circular No. PFRDA/2025/16/Reg-PF/02 dated 17 October 2025.

Asset Allocation Under Default Scheme (Annexure I)

Why This Matters

This move by PFRDA gives Central Government employees greater flexibility to align their NPS portfolios with personal risk tolerance and market expectations.

With more equity-focused options, younger subscribers can aim for higher long-term returns while conservative investors can stick to traditional low-risk allocations.

By expanding investment choices and improving transparency, the NPS continues to evolve into a more dynamic and customizable retirement savings system.