Section 80G of the Income Tax Act, 1961 provides a deduction while computing the total income of an assessee in respect of donations made to specified funds, charitable institutions, trusts and approved bodies. To promote voluntary tax compliance and to reduce errors in return filing, the Income Tax Department has issued detailed FAQs under the NUDGE Campaign, explaining the scope, conditions, limits and procedural requirements relating to deductions under Section 80G. Here we will discuss on FAQs on Section 80G of the Income Tax Act.

This detailed guide explains the statutory structure of Section 80G, the types of eligible donations, deduction limits, verification mechanisms and common compliance issues.

Structure of Section 80G Explained

Section 80G is a self-contained provision comprising multiple sub-sections, each serving a specific purpose.

Sub-section (1) explains how the deduction is to be computed. If donations include “special funds” listed under sub-section (2), the assessee is eligible for 100% deduction on such special donations and 50% deduction on the remaining eligible donations. If donations are made only to “other eligible funds”, the deduction is restricted to 50% of the total donation amount.

Sub-section (2) contains a comprehensive master list of funds and institutions eligible for deduction. Clause (a) lists government funds, national relief funds and approved institutions. Certain funds qualify for 100% deduction without limit, while others qualify for 50% deduction without limit. Clauses (b), (c) and (d) cover donations for renovation of notified religious places, corporate donations for sports infrastructure and specified earthquake relief donations.

Sub-section (4) prescribes a maximum ceiling of 10% of Adjusted Gross Total Income for certain categories of donations. Any amount exceeding this qualifying limit is ignored for deduction purposes.

Income Tax Latest News & FAQs (2025): Refund Delays, ITR Mismatch, Revised Returns & Foreign Assets

Sub-section (5) lays down nine mandatory conditions that an institution must satisfy to be eligible for approval under Section 80G. These include exemption of income under Sections 11, 12 or specified clauses of Section 10, maintenance of regular accounts, prohibition on non-charitable use of funds, non-religious and non-caste-specific objectives, valid registration, approval by the Principal Commissioner or Commissioner of Income Tax, filing of prescribed statements and issuance of donation certificates.

Sub-section (5A) clearly states that a single donation can be claimed only once. If deduction is allowed under Section 80G, the same amount cannot be claimed under any other provision of the Act.

Sub-section (5D) restricts cash donations exceeding Rs. 2,000, allowing deduction only where payment is made through cheque, demand draft or electronic modes.

FAQs on Section 80G of the Income Tax Act

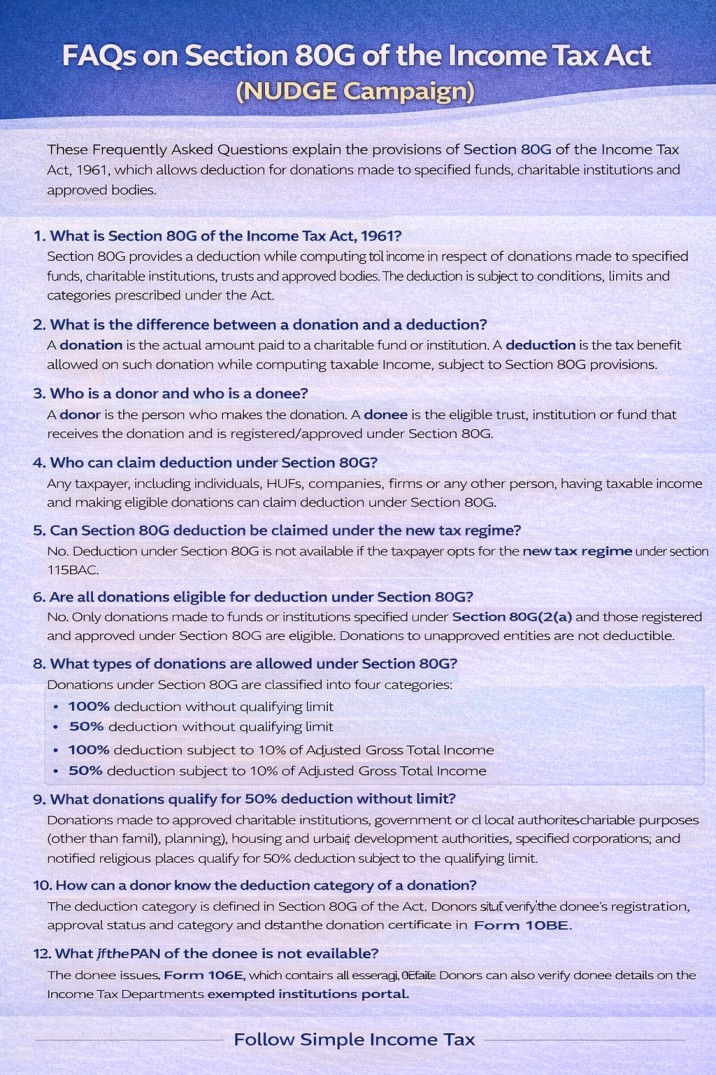

These Frequently Asked Questions explain the provisions of Section 80G of the Income Tax Act, 1961, which allows deduction for donations made to specified funds, charitable institutions and approved bodies.

1. What is Section 80G of the Income Tax Act, 1961?

Section 80G provides a deduction while computing total income in respect of donations made to specified funds, charitable institutions, trusts and approved bodies. The deduction is subject to conditions, limits and categories prescribed under the Act.

2. What is the difference between a donation and a deduction?

A donation is the actual amount paid to a charitable fund or institution. A deduction is the tax benefit allowed on such donation while computing taxable income, subject to Section 80G provisions.

3. Who is a donor and who is a donee?

A donor is the person who makes the donation. A donee is the eligible trust, institution or fund that receives the donation and is registered/approved under Section 80G.

4. Who can claim deduction under Section 80G?

Any taxpayer, including individuals, HUFs, companies, firms or any other person, having taxable income and making eligible donations can claim deduction under Section 80G, provided the old tax regime is opted.

5. Can Section 80G deduction be claimed under the new tax regime?

No. Deduction under Section 80G is not available if the taxpayer opts for the new tax regime under section 115BAC.

6. Are all donations eligible for deduction under Section 80G?

No. Only donations made to funds or institutions specified under Section 80G(2)(a) and those registered and approved under Section 80G are eligible. Donations to unapproved entities are not deductible.

7. What types of donations are allowed under Section 80G?

Donations under Section 80G are classified into four categories:

- 100% deduction without qualifying limit

- 50% deduction without qualifying limit

- 100% deduction subject to 10% of Adjusted Gross Total Income

- 50% deduction subject to 10% of Adjusted Gross Total Income

8. What donations qualify for 100% deduction without limit?

Donations to specified national and government funds listed under Section 80G(2)(a)(i) to (iiihm) and Section 80G(2)(d), such as defence, relief and national welfare funds, qualify for 100% deduction without any limit.

9. What donations qualify for 50% deduction without limit?

Donations to specified funds such as the Prime Minister’s Drought Relief Fund qualify for 50% deduction without any qualifying limit.

10. What donations qualify for 100% deduction with qualifying limit?

Donations made to government or approved bodies for promoting family planning under Section 80G(2)(a)(vii), and corporate donations for sports infrastructure and sponsorship under Section 80G(2)(c), qualify for 100% deduction subject to the qualifying limit.

11. What donations qualify for 50% deduction with qualifying limit?

Donations made to approved charitable institutions, government or local authorities for charitable purposes (other than family planning), housing and urban development authorities, specified corporations, and notified religious places qualify for 50% deduction subject to the qualifying limit.

12. How can a donor know the deduction category of a donation?

The deduction category is defined in Section 80G of the Act. Donors should verify the donee’s registration, approval status and category and obtain the donation certificate in Form 10BE.

13. Are cash donations eligible for deduction under Section 80G?

No deduction is allowed for cash donations exceeding Rs. 2,000. Donations must be made through cheque, demand draft or electronic modes to qualify.

14. Can the same donation be claimed under another section?

No. If deduction is claimed under Section 80G, the same amount cannot be claimed under any other provision of the Income Tax Act.

15. How does the Income Tax Department verify Section 80G claims?

Deduction claims are verified based on information furnished by the donee institution in Form 10BD. The claim made in the ITR must match the details reported by the donee.

16. How is Section 80G deduction claimed in the Income Tax Return?

The deduction is claimed under Schedule 80G in the ITR by entering the donee’s details, donation amount and eligible deduction.

17. What details are required to claim deduction under Section 80G?

The donor must have a donation receipt containing:

- Name and PAN of the donee

- Address of the donee

- 80G registration number

- Amount donated

18. What if the PAN of the donee is not available?

The donee issues Form 10BE, which contains all essential details. Donors can also verify donee details on the Income Tax Department’s exempted institutions portal.

19. Can excess donation amount be carried forward?

No. Any excess donation beyond the qualifying limit cannot be carried forward to subsequent years.

20. What if the donee institution loses its 80G registration?

Donations made after cancellation or expiry of 80G approval are not eligible for deduction. Donors must verify the donee’s approval status for the relevant year.

21. What is Adjusted Gross Total Income?

Adjusted Gross Total Income is Gross Total Income reduced by deductions under Chapter VI-A (except 80G), exempt income, long-term capital gains, short-term capital gains under section 111A and incomes taxed at special rates.

22. How is deduction under Section 80G calculated?

First compute Adjusted Gross Total Income. Then calculate 10% of this amount as the qualifying limit. Apply the applicable deduction percentage based on the donation category.