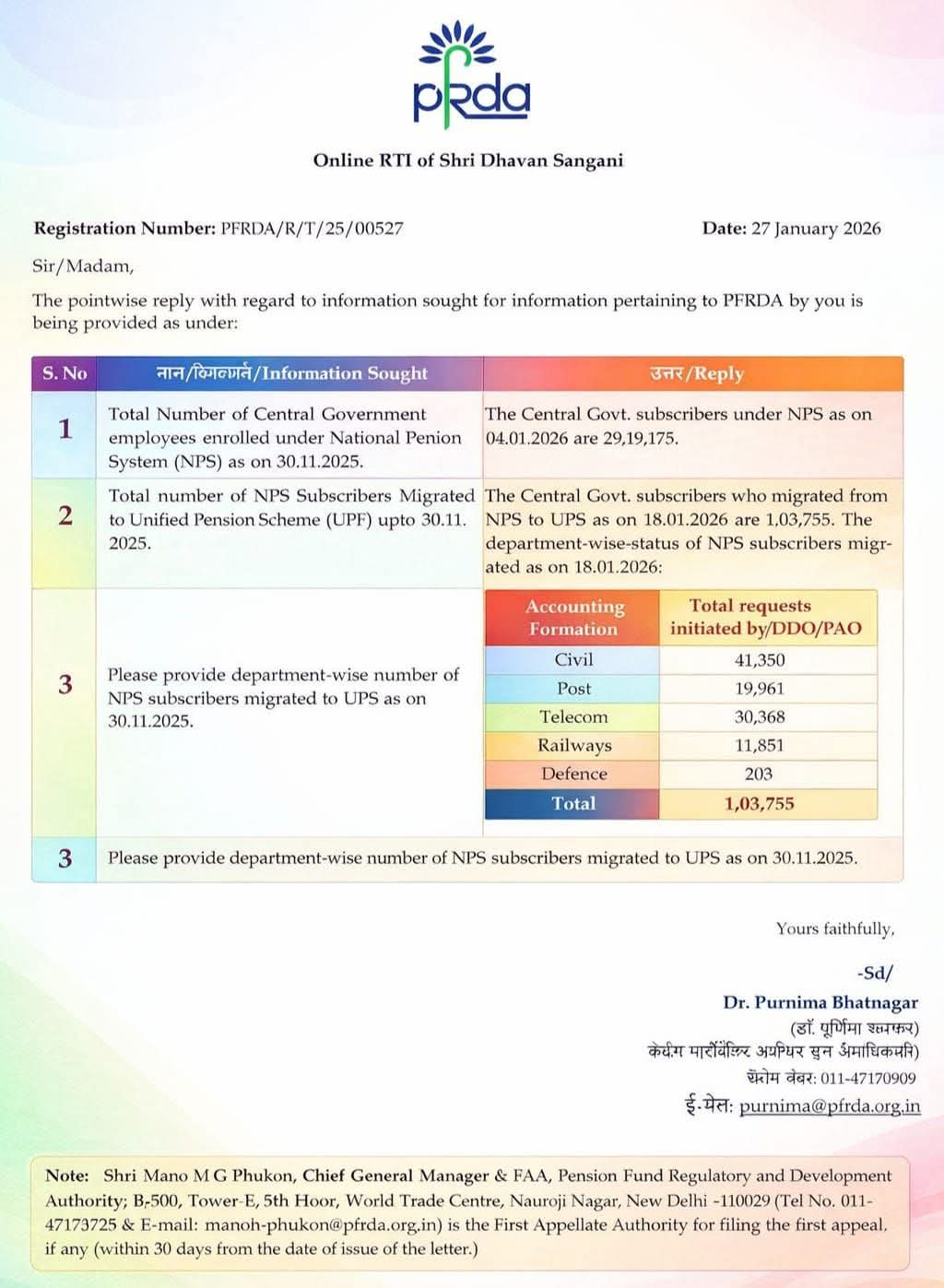

A recent Right to Information (RTI) reply issued by the Pension Fund Regulatory and Development Authority (PFRDA) has provided fresh insights into how Central Government employees are choosing between the National Pension System (NPS) and the Unified Pension Scheme (UPS). The information, dated 27 January 2026, sheds light on both the total number of employees currently enrolled under NPS and those who have migrated to UPS. Over 1 Lakh Central Government Employees Shift UPS

Total Central Government Employees under NPS

As per the RTI response, the total number of Central Government employees enrolled under NPS stood at 29,19,175 as on 30 November 2025. This figure shows that NPS continues to remain the primary pension framework for a large section of government staff across ministries and departments.

NPS was introduced as a contributory pension model where both the employee and the government contribute regularly, and the final pension depends on market-linked returns. Over the years, it has covered lakhs of government employees who joined service after the discontinuation of the Old Pension Scheme.

Number of Employees Migrating to UPS

The RTI reply also revealed that 1,03,755 Central Government subscribers migrated from NPS to UPS as on 18 January 2026. This number reflects a noticeable shift in pension preference among employees who are seeking more predictable or assured pension benefits.

The Unified Pension Scheme (UPS) has attracted attention because it is perceived by many employees as offering greater certainty in retirement income compared to the market-linked nature of NPS. While NPS focuses on long-term investment growth, UPS is often seen as a more structured pension alternative.

Department-Wise Migration Data

The RTI response further included a department-wise break-up of migration requests initiated through Drawing and Disbursing Officers (DDOs) and Pay and Accounts Offices (PAOs). The figures show how different sectors of the Central Government are responding to the option of migration:

- Civil Departments: 41,350 employees

- Postal Department: 19,961 employees

- Telecom Department: 30,368 employees

- Railways: 11,851 employees

- Defence: 203 employees

Total Migration Requests: 1,03,755

From the data, it is clear that Civil departments account for the highest migration numbers, followed by Telecom and Postal departments. The Defence sector shows comparatively very low migration figures, which may be due to different service conditions or existing pension structures.

Why This Data Is Important

This RTI disclosure is significant because it provides official, transparent figures on pension choices made by Central Government employees. Pension planning is a critical aspect of government service, and even small changes in scheme preference can have large-scale financial and policy implications.

The migration trend also indicates that employees are actively reviewing their retirement options instead of passively continuing with existing systems. It highlights the growing awareness among government staff regarding pension structures, long-term financial security, and post-retirement income stability.

Impact on Pension Policy Discussions

The release of this data is likely to influence ongoing discussions about pension reforms, employee welfare, and financial sustainability of pension schemes. Policymakers, employee unions, and financial planners often rely on such official numbers to assess how widely accepted a pension framework is and whether modifications are required.

While NPS continues to cover the majority of employees, the fact that over one lakh employees have opted for migration within a short period shows that UPS is gaining visibility and acceptance. However, the long-term impact of this shift will depend on future government policies, financial commitments, and employee awareness.

The RTI reply from PFRDA offers a clear snapshot of the current pension landscape among Central Government employees. With 29 lakh employees still under NPS and over 1 lakh migrating to UPS, the data reflects both stability and change within the pension ecosystem. As retirement planning becomes increasingly important, such official disclosures help employees make informed decisions about their financial future.

Source : PFRDA