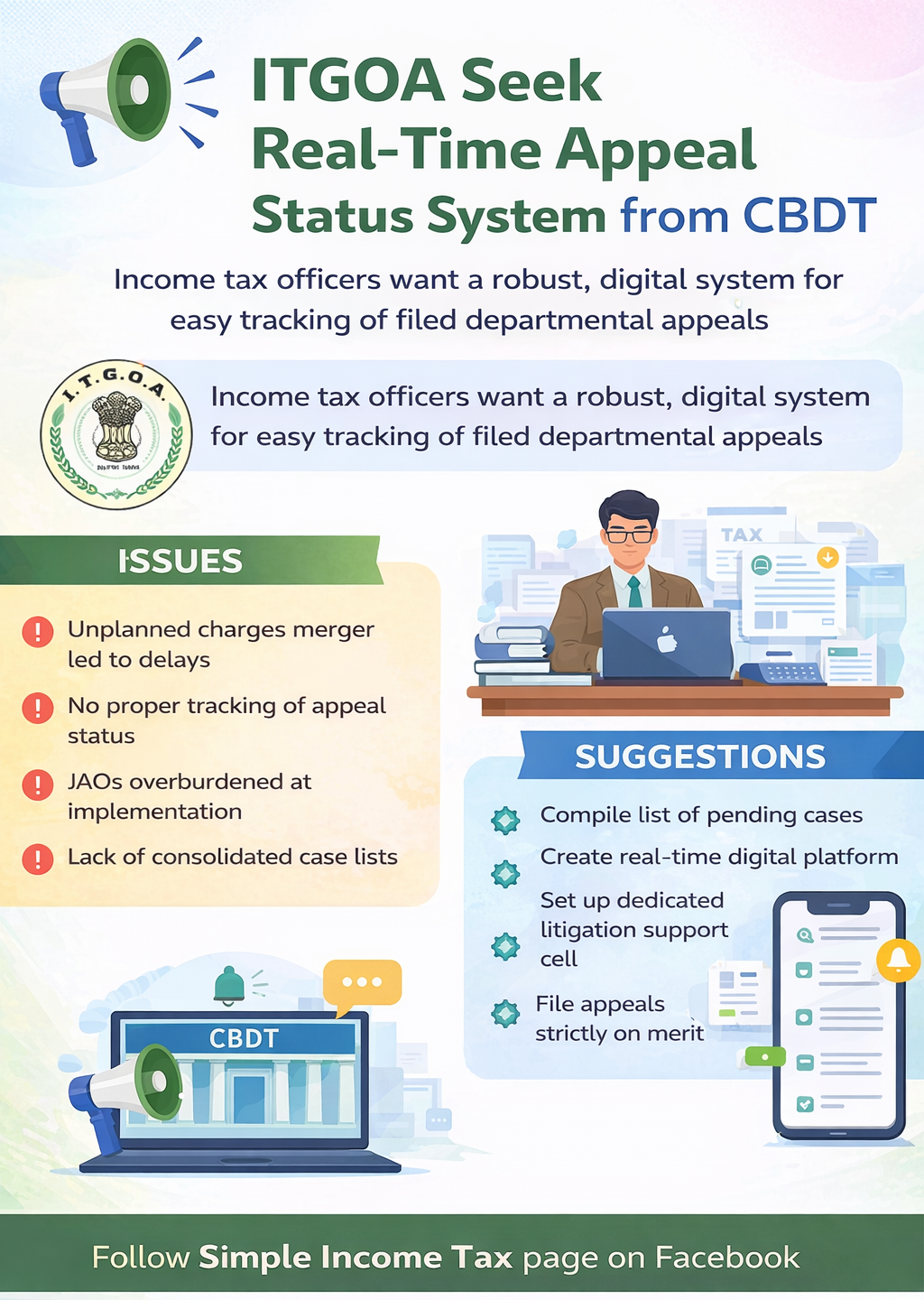

The Income Tax Gazetted Officers’ Association (ITGOA) has written to the Central Board of Direct Taxes (CBDT) requesting the creation of a robust digital mechanism for real-time status updates of departmental appeals and better support for officers handling litigation work. ITGOA Seek Real-Time Appeal Status System from CBDT.

In a letter dated 27 January 2026, the Association highlighted practical challenges faced by departmental officers—particularly Jurisdictional Assessing Officers (JAOs)—in filing appeals on time and tracking the progress of cases pending before High Courts and the Supreme Court.

Background: Court Concerns on Delayed Appeals

The representation refers to a recent judgment of the Delhi High Court, where the Hon’ble Bench expressed concern over belated appeals being filed with routine or mechanical explanations citing procedural delays. The Court advised the Department to put in place an effective mechanism to ensure timely filing of appeals and cautioned that appeals filed beyond limitation without proper justification could attract penal costs of ₹5,000 per day.

Following this, directions were circulated within the Department, including the possibility of administrative action against erring officers where necessary.

Key Issues Raised by Officers

The Association submitted that delays are often systemic rather than individual. One major reason cited is the unplanned merger of JAO charges during 2019–2020, where multiple wards and circles were combined overnight. Newly posted officers frequently took charge without proper handover notes or visibility into pending judicial matters. As a result, old cases surfaced much later, unintentionally delaying appeal filings.

Other operational constraints mentioned include:

- Excessive workload and unrealistic timelines

- Inadequate staff strength

- Avoidable reporting requirements

- Deficiencies in departmental IT systems (such as ITBA)

- Lack of consolidated lists of pending cases for each charge

According to the Association, while courts may not always be aware of these internal administrative limitations, the entire onus often falls on individual officers during implementation.

Difficulty in Tracking Case Status

Even after appeals are filed, officers reportedly face difficulty in tracking case progress. Field offices are sometimes not promptly informed when cases are filed before the Supreme Court of India, and critical details such as Diary Numbers or SLP Numbers are not consistently shared. Officers then have to manually search court websites, which becomes especially challenging when large batches of cases are tagged under a lead matter.

The issue is compounded by the absence of exhaustive, updated lists of pending cases for each JAO charge, making compliance with court directions and timely representation more difficult.

Suggestions Made to CBDT

To address these challenges, the Association proposed several practical measures:

- Preparation of a comprehensive list of all pending departmental cases before High Courts and the Supreme Court in coordination with court registries.

- Development of a centralized digital platform or alert-based system to provide real-time updates on filing status, case numbers, hearing dates, and orders.

- Dedicated litigation support cells at the level of Principal Commissioners/Commissioners to assist JAOs.

- Merit-based recommendations for appeal filing instead of routine, mechanical decisions driven only by monetary limits.

- Greater emphasis on the principle of collective responsibility, rather than placing the entire burden on junior officers.

Why This Matters

Litigation management is a critical function of the tax administration. Timely filing of appeals and accurate tracking of case status help protect government revenue, reduce adverse judicial observations, and improve institutional credibility. A technology-enabled, real-time system could significantly reduce procedural delays, improve coordination between field formations and headquarters, and enhance overall efficiency.

The Association’s representation underscores the need for system-level reforms and digital solutions in managing departmental litigation. By introducing real-time status tracking, centralized data repositories, and structured support mechanisms, the Department can strengthen appeal management while ensuring fairness and shared accountability across all levels.

Source : ITGOA