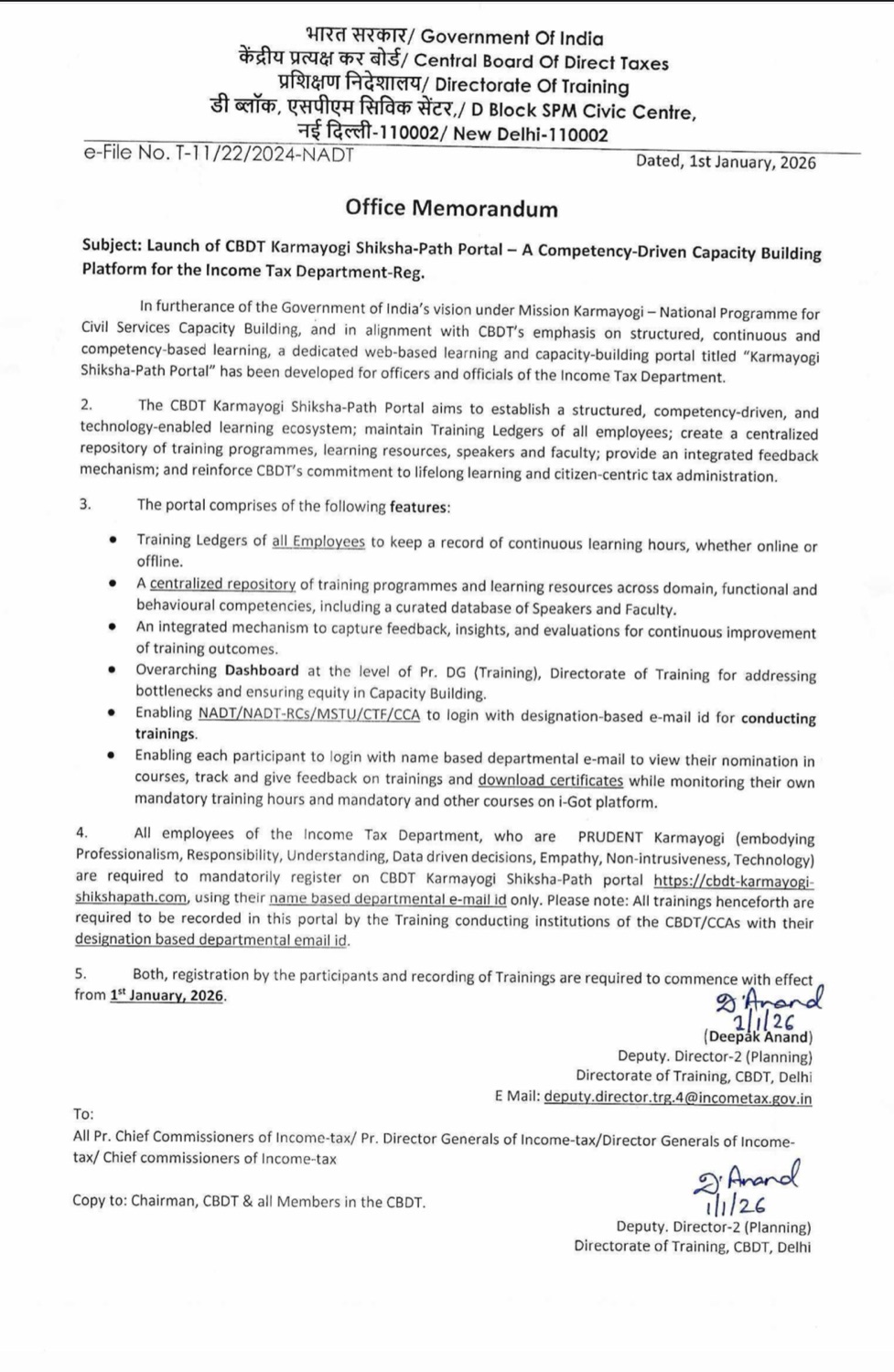

The Central Board of Direct Taxes (CBDT) has launched a new digital learning platform called the CBDT Karmayogi Shiksha-Path Portal for officers and officials of the Income Tax Department. The portal has been introduced through an Office Memorandum dated 1 January 2026 issued by the Directorate of Training, CBDT.

This initiative is part of the Government of India’s Mission Karmayogi – National Programme for Civil Services Capacity Building and reflects CBDT’s focus on structured, continuous, and competency-based learning for its workforce.

Purpose of the Karmayogi Shiksha-Path Portal

The Karmayogi Shiksha-Path Portal has been designed as a competency-driven and technology-enabled capacity-building platform. Its main objective is to create a structured learning ecosystem within the Income Tax Department while promoting lifelong learning and citizen-centric tax administration.

The portal will serve as a single, centralized system to record training details, learning hours, and feedback, ensuring transparency and uniformity in training across the Department.

Key Features of the Portal

The portal includes Training Ledgers for all employees to maintain a record of learning hours, whether through online or offline training programmes. It also provides a centralized repository of training programmes and learning resources covering domain, functional, and behavioural competencies, along with a curated database of speakers and faculty.

An integrated feedback mechanism has been built into the portal to capture participant feedback, insights and evaluations for continuous improvement in training quality. A comprehensive dashboard at the level of Principal Director General (Training) will help identify gaps, monitor progress and ensure equity in capacity building across regions.

Training institutions such as NADT, NADT-RCs, MSTU, CTF and CCAs will be able to log in using designation-based departmental email IDs to conduct and record training programmes. Individual participants will log in using their name-based departmental email IDs to view course nominations, track training attendance, provide feedback, download certificates and monitor mandatory training hours, including courses linked with the iGOT platform.

Mandatory Registration for All Employees

All employees of the Income Tax Department are required to mandatorily register on the CBDT Karmayogi Shiksha-Path Portal using their name-based departmental email ID only. The memorandum emphasizes that all future trainings must be recorded exclusively on this portal by the training-conducting institutions using their designation-based email IDs.

This requirement applies to all PRUDENT Karmayogi officers, reflecting the Department’s values of Professionalism, Responsibility, Understanding, Data-driven decision-making, Empathy, Non-intrusiveness and Technology orientation.

Effective Date

Both registration by participants and recording of trainings on the portal are mandatory with effect from 1 January 2026.

Why This Matters

The launch of the Karmayogi Shiksha-Path Portal marks a significant step toward modernizing training and capacity building in the Income Tax Department. By centralizing training records and aligning learning with competencies, CBDT aims to build a future-ready workforce capable of handling evolving tax laws, technology-driven systems and taxpayer-focused administration.