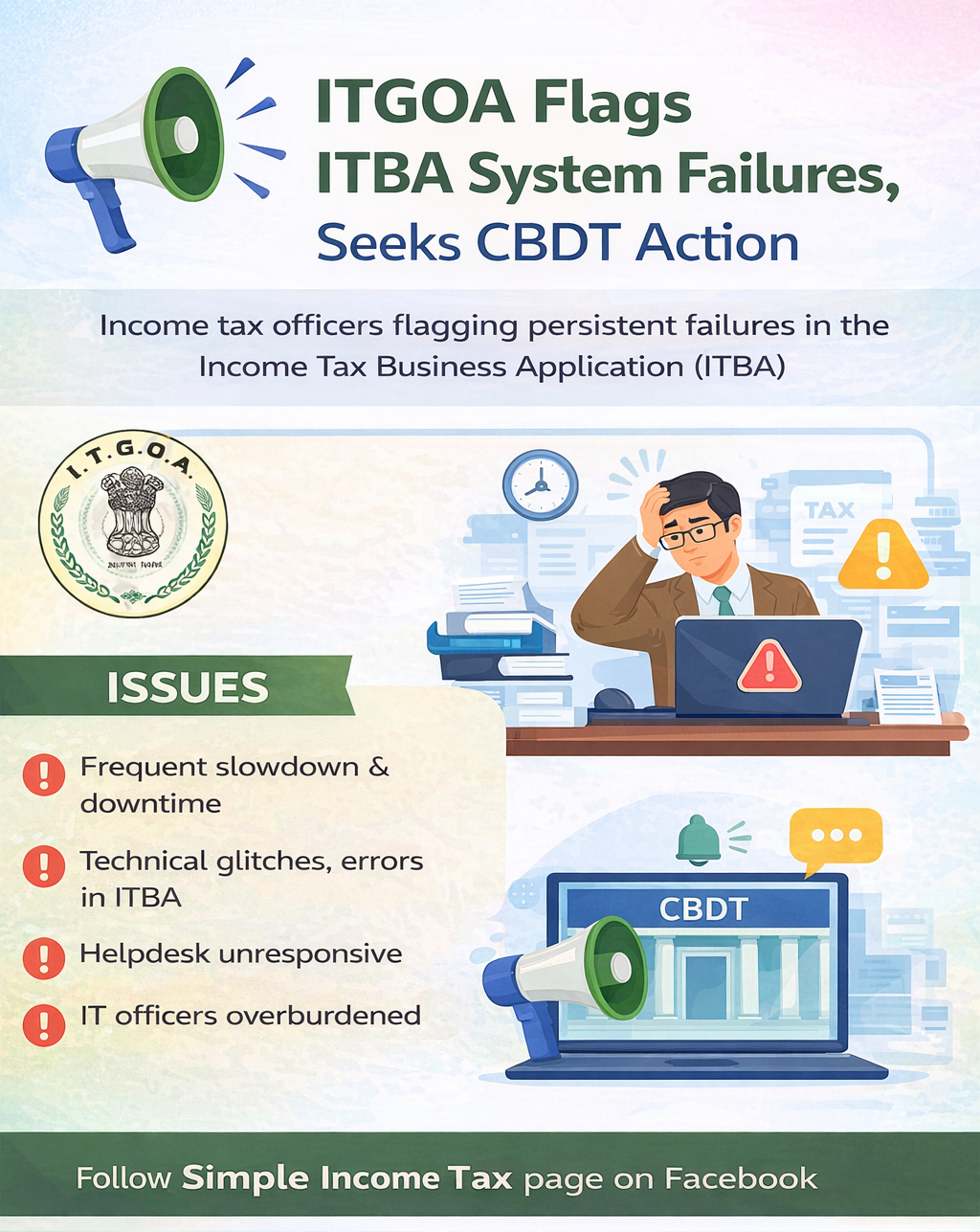

The Income Tax Gazetted Officers’ Association (ITGOA) has submitted a detailed representation to the Central Board of Direct Taxes (CBDT) highlighting serious and persistent performance failures in the Income Tax Business Application (ITBA) platform. The letter, dated 27 January 2026, points out that ongoing technical glitches, slow processing speed, and unresolved system errors are causing severe operational hardship to field officers and are adversely affecting the quality and timeliness of income tax assessments. ITGOA Highlights ITBA Glitches, Seeks Urgent Reform

The Association has urged the Board to take urgent corrective action and institute continuous monitoring of ITBA performance, helpdesk responsiveness, and CPC processing timelines to safeguard the efficiency and credibility of tax administration.

What Is ITBA and Why It Is Important

The Income Tax Business Application (ITBA) is the primary digital platform used by Income Tax officers across India. It is designed to handle almost every core function of tax administration, including:

- Issuing notices and summons

- Conducting assessments and penalty proceedings

- Uploading orders and rectifications

- Tracking appeals and litigation

- Managing tax recovery and compliance data

- Coordinating with CPC and other departmental systems

Because ITBA acts as the backbone of digital tax administration, any slowdown or technical malfunction directly impacts day-to-day departmental operations and the ability of officers to meet statutory deadlines.

Core Problems Highlighted by the Association

According to the representation, the ITBA platform has been facing continuous technical instability since the beginning of the year, with conditions deteriorating sharply from December onward. Officers across field formations are reportedly encountering:

- Extreme slowness and prolonged buffering

- Frequent and unannounced system downtime

- Frozen screens and inactive radio buttons

- Incorrect backend computations despite correct entries

- Delayed or failed notice generation

- Work items not opening for extended periods

- MIS reports not updating regularly

The Association noted that even routine functions such as generating Show Cause Notices, computation of tax, or uploading final orders are taking hours or even days, leading to cascading delays.

Loss of Productive Man-Hours

One of the most significant concerns raised is the massive loss of productive man-hours. Officers and supporting staff are reportedly spending a large portion of their working time raising helpdesk tickets, following up on unresolved technical issues, and repeating the same tasks multiple times due to system errors.

Instead of focusing on substantive assessment work—such as analyzing returns, verifying documents, and drafting reasoned orders—officers are often stalled by technical bottlenecks. This diversion of time and effort is said to be directly impacting:

- Quality of assessment orders

- Compliance with Board-mandated action plans

- Timely completion of statutory duties

- Overall departmental productivity

Illustrative Technical Issues Mentioned

The representation lists numerous recurring technical problems. Some of the commonly reported issues include:

- Inability to generate Show Cause Notices (SCNs) or ILDPs, or repeated attempts required

- ‘Sending Failed’ errors appearing after notice generation

- Notices under Section 133(6) remaining pending for signature for over a week

- Certain penalty modules (such as Section 271AAE) not visible in the system

- Chapter VI-A deductions not being allowed despite eligibility

- Missing pre-filled data in computation screens

- Failure to submit final feedback, delaying final order generation

- Final assessment orders stuck at CPC accounting stage for months

- Virtual hearing URLs not being received or letters remaining unsigned

- Manual order uploads pending for extended periods due to helpdesk inactivity

- Difficulty accessing ITBA or allied systems through laptops

- Helpdesk tickets being closed without proper resolution

Special Challenges Faced by Jurisdictional Assessing Officers (JAOs)

The situation is reportedly more difficult for Jurisdictional Assessing Officers (JAOs) who handle multiple responsibilities simultaneously. JAOs are required to manage assessment notices, penalty proceedings, rectifications, appellate effects, demand classifications, recovery actions, advance-tax communications, and grievance portals such as e-Nivaran and CPGRAMS—all through a single-window token system.

When the system runs slowly or crashes, it creates a chain reaction of delays affecting multiple cases at once. Officers also face difficulties downloading appeal orders, marking recoverability status for CPC, and handling rectification orders due to system lag.

Concern Over Institutional vs Individual Responsibility

A central theme of the representation is the concern that institutional technology failures are being treated as individual officer shortcomings. The Association emphasized that delays caused by systemic issues—such as platform slowness, CPC bottlenecks, or inadequate helpdesk support—should not lead to adverse remarks or punitive actions against officers who have limited control over these factors.

The letter calls for recognition of collective and institutional responsibility rather than placing the entire burden on field-level officers.

Suggestions and Requested Corrective Measures

To address the ongoing crisis, the Association has requested the CBDT to consider several practical steps:

- Continuous and focused monitoring of ITBA system performance

- Strengthening helpdesk support and technical escalation mechanisms

- Ensuring faster CPC processing and timely accounting closures

- Providing adequate hardware and laptop access to field officers

- Reducing avoidable reporting requirements while technical issues persist

- Instituting accountability for system-level deficiencies rather than penalizing individual officers

Why This Issue Matters for Tax Administration

Efficient digital systems are critical for modern tax governance. Persistent ITBA failures can delay taxpayer communications, affect compliance timelines, and undermine confidence in the administrative process. A stable and responsive technology platform is essential not only for officers but also for taxpayers who depend on timely notices, orders, and grievance redressal.

The representation submitted by the Income Tax Gazetted Officers’ Association highlights the urgent need for technology upgrades, improved technical support, and institutional accountability within the tax administration ecosystem. Addressing ITBA performance issues will ease operational stress on officers, improve the quality of assessments, and strengthen the overall efficiency and credibility of the Income Tax Department’s digital infrastructure.

Source : ITGOA