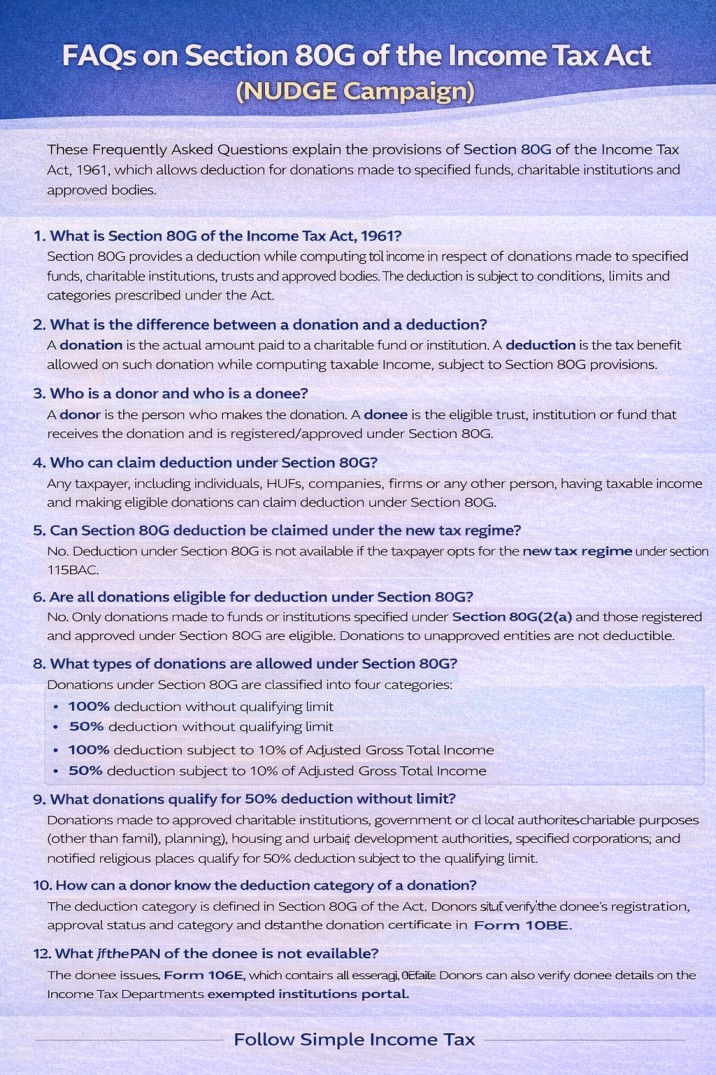

Section 80G of the Income Tax Act, 1961 provides a deduction while computing the total income of...

Month: December 2025

The Pension Fund Regulatory and Development Authority (PFRDA) has notified the PFRDA (Exits and Withdrawals under the...

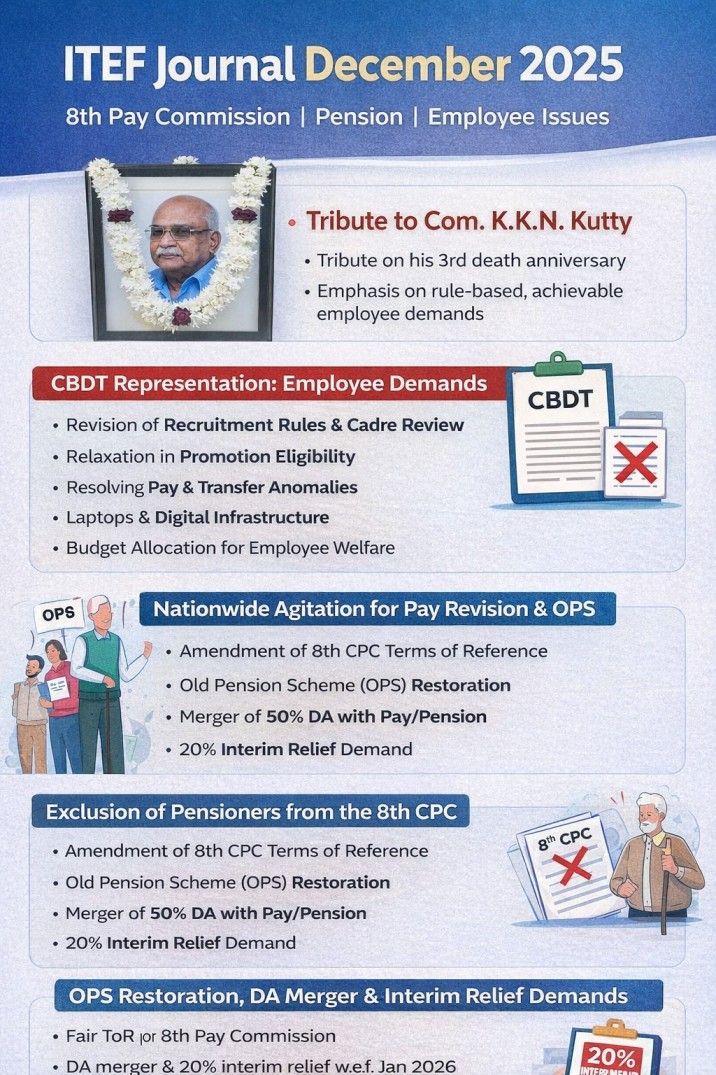

The December 2025 edition of The Journal of the Income Tax Employees Federation (ITEF) captures a decisive...

Why income tax refunds are delayed in 2025 and what ITR mismatch means—explained with revised return and...

The government has clarified in Parliament that no funds have been allocated in the upcoming Union Budget...

The Central Board of Direct Taxes (CBDT) has issued a strong advisory urging taxpayers to avoid making...

In a major move towards protecting workers’ mental health and personal time, the Right to Disconnect Bill,...

The November 2025 edition of The Journal of the Income Tax Employees Federation covers major developments impacting...

Procurement of goods and services is a vital responsibility in government functioning, especially in departments like Income...

The Pension Fund Regulatory and Development Authority (PFRDA) has issued a major update on December 1, 2025...