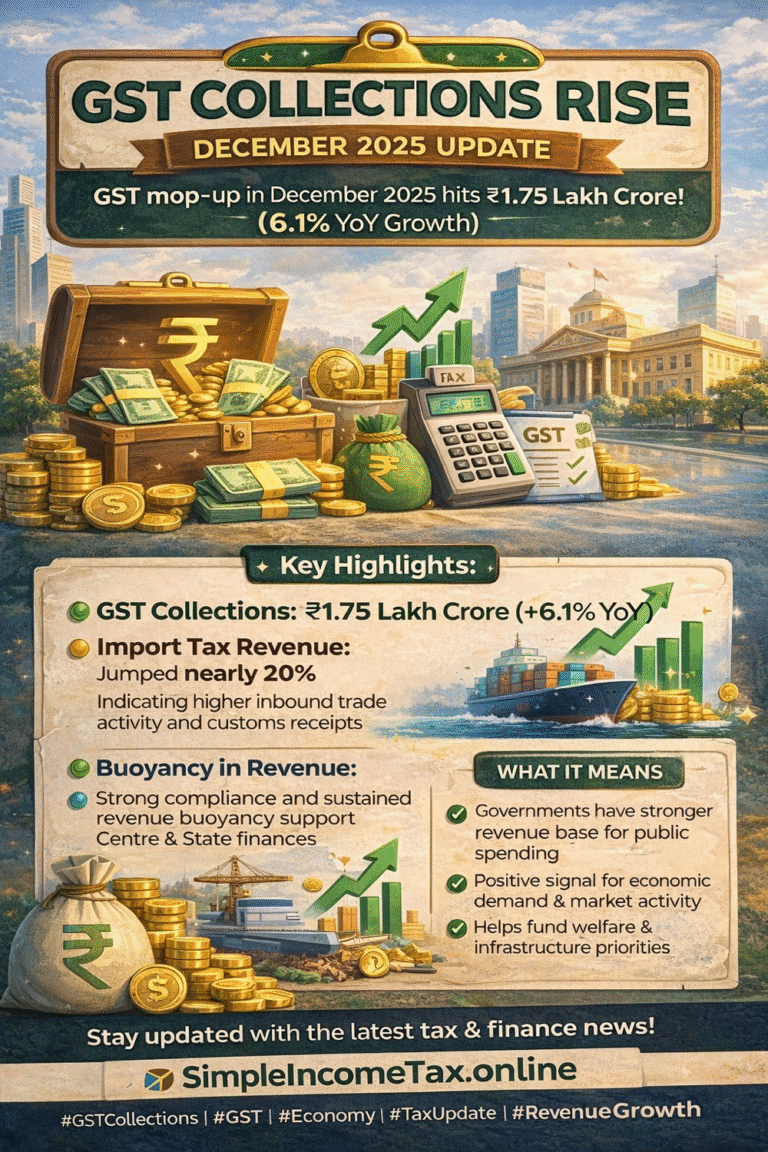

India’s Goods and Services Tax (GST) collections showed steady growth in December 2025, reflecting continued economic activity...

Taxpayer’s Corner

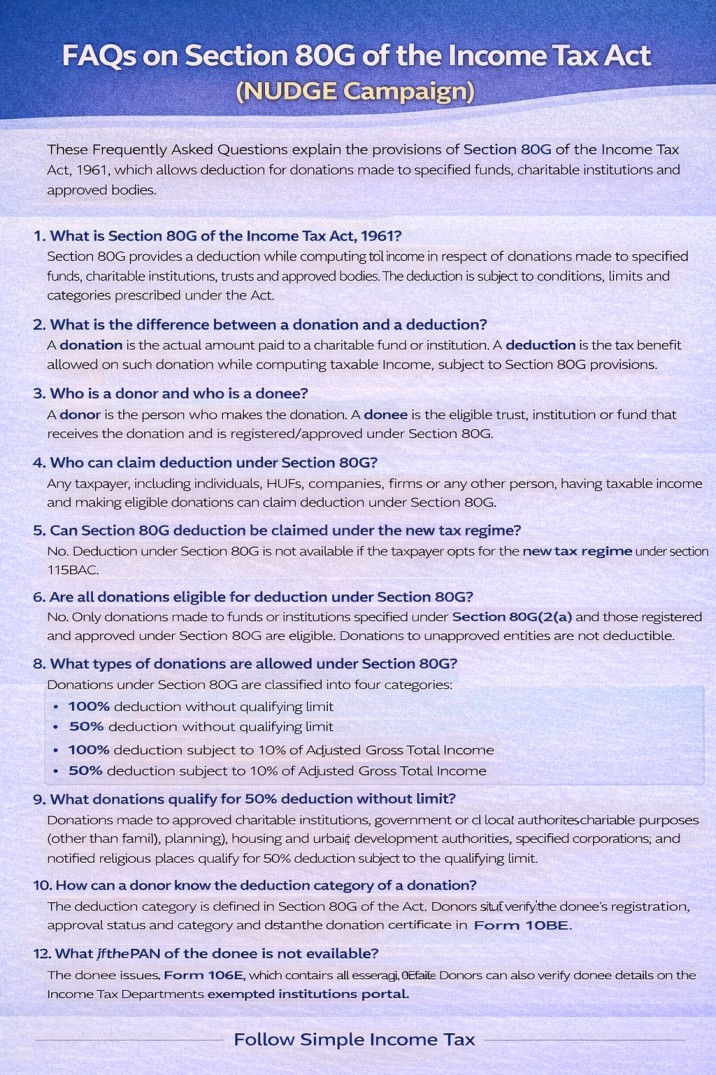

Section 80G of the Income Tax Act, 1961 provides a deduction while computing the total income of...

Why income tax refunds are delayed in 2025 and what ITR mismatch means—explained with revised return and...

The Central Board of Direct Taxes (CBDT) has issued a strong advisory urging taxpayers to avoid making...

The process of Income Tax Return (ITR) filing in India is about to undergo a major revamp....

In a significant ruling, the Delhi High Court has once again clarified that both the Jurisdictional Assessing...

The Confederation of Central Government Employees & Workers has submitted a detailed representation to the Hon’ble Prime...

CBDT is launching a nationwide outreach programme to prepare taxpayers and officials for the new Income-tax Act,...

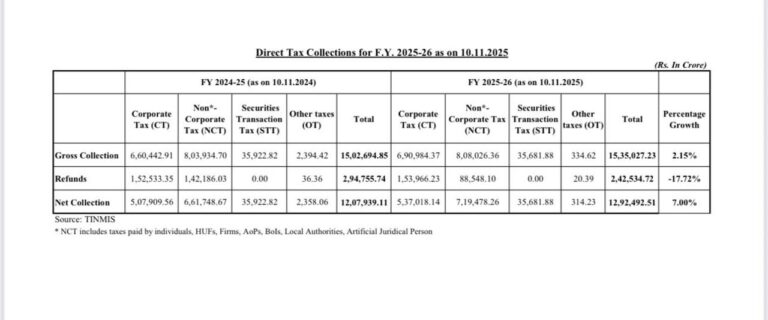

The Central Board of Direct Taxes (CBDT) has released the provisional figures of Gross Direct Tax Collections,...